On March 18th, 2020, US Well Services issued notices of immediate termination to hundreds of employees. The Texas-based fracking business cited the effects of the early COVID-19 pandemic as reasoning behind the mass layoff.

Many of the former US Well Services’ employees filed claims under the WARN Act, a law that protects workers from unexpected termination. US Well Services, however, believed it rightfully terminated its employees because it considered COVID-19 a “natural disaster,” one of the exemptions to the WARN Act’s protocol.

But on June 15, 2022, the US Court of Appeals for the Fifth Circuit held that “COVID-19 does not qualify as a natural disaster under the WARN Act” limiting natural disaster to “hydrological, geological, and meteorological events.”

With the new court ruling, it’s important that employees understand their rights under the WARN Act. Here are six things you need to know about the WARN Act.

What is the WARN Act?

The WARN Act, or Workers Adjustment and Retraining Notification Act, is a law passed in 1988. US Congress passed this law requiring employers to provide written notice for employees 60 days ahead of mass loss of employment. They hoped to protect workers from the impacts of termination, layoffs exceeding six months, or a reduction of working hours by 50% in six months.

This notice provides workers with enough time to develop new skills, refine existing ones, and prepare for workplace transitions. On top of that, a well-intentioned notice also provides information and resources for new job opportunities.

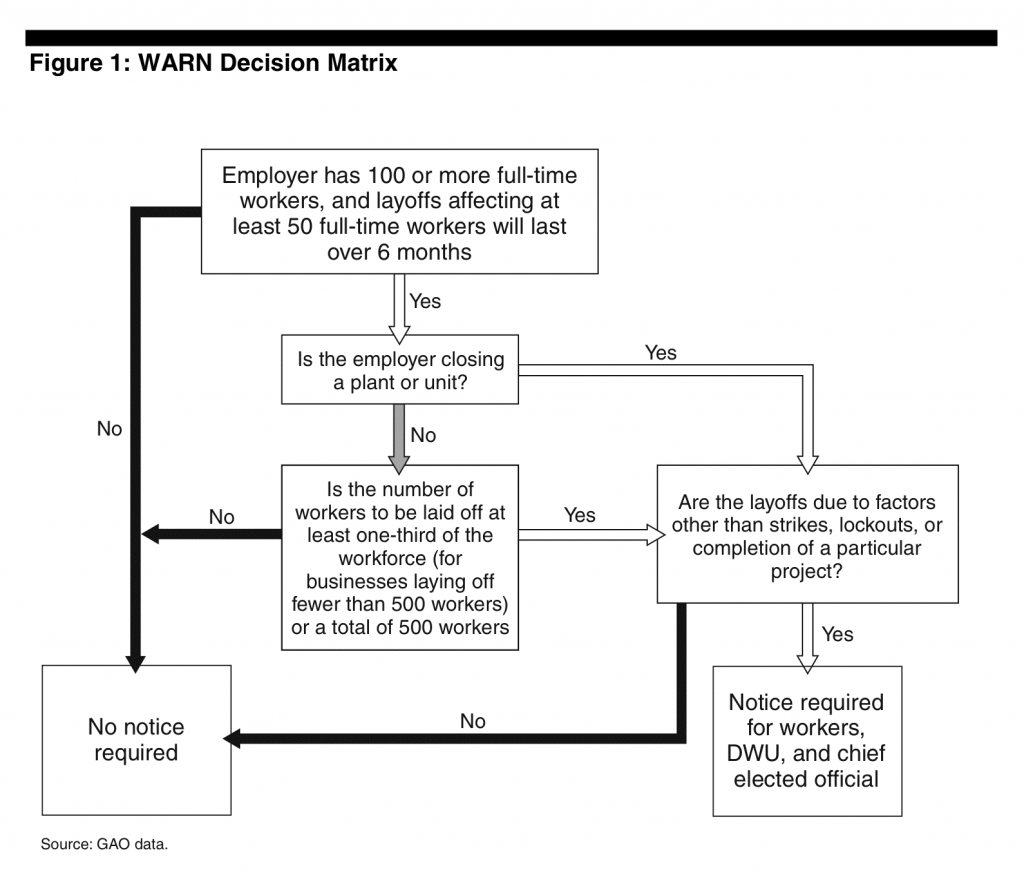

Companies covered by the WARN Act have to meet certain criteria, such as employing 100 or more full-time workers at a single site of employment for at least six months. Apart from this, the WARN Act also covers private for-profit or non-profit organizations, or public entities separately organized from the government if they employ 100 or more workers who work a combined 4,000 hours a week.

Employers are required to provide notice if:

- Closing a facility leads to the loss of at least 50 full-time employees that make up 33% of a single site of employment.

- 500 or more full-time employees at a single site will lose employment status.

- leading to plant closures or mass layoffs. In this case, former employers must notify their employees 60 days before the sale date and time. Then the new employer must notify employees after the sale date and time if there is to be a plant closure or mass layoff.

- If a company or a division of company is sold, then all affected areas must be notified.

QUALIFICATIONS AND EXEMPTIONS

The WARN Act does not apply to every business, and not every case of termination requires notice. So, it is important for employees to be aware of the specific circumstances and exemptions for the WARN Act.

To qualify under the WARN Act, an employee:

- Cannot be federal, state, or local

- Cannot be business partners.

- Must work more than 20 hours a week and must have worked at the site of employment for at least 6 months.

- Can be either salaried or hourly workers.

- Cannot be on strike.

- Cannot be temporary or contract employees.

There are some circumstances that do not trigger the WARN protocol, including a temporary worksite shutting down, or when a strike causes a facility to close.

There are also specific exemptions to 60-day notices, in which employers are not obligated to notify employees of closures or layoffs in advance. These are:

- when a company is faltering. If a company is actively seeking capital or business, they might believe an advanced notice of termination would diminish the opportunity to obtain such assets;

- unforeseeable business circumstances. when a sudden, dramatic, and unexpected action or condition outside the employer’s control was not reasonably foreseen at the time that a 60-day notice would have been required;

- in case of natural disaster. When a plant closing or mass layoff is directly the result of a natural disaster such as a flood, earthquake, or drought, and anything causing similar effects of nature.

Although these few qualifiers do exempt companies from adhering to the WARN protocol, employers should still issue loss of employment notices as soon as the news becomes available.

Employer Responsibility

An employer must adhere to a set of guidelines when notifying employees of termination. The contents of the notice must be clearly written and easy to understand. Any notice must contain:

- A statement indicating the extent of the plant’s closure or layoff, and for how long if temporary;

- The expected date that the closing or layoff will commence;

- Whether bumping rights exist;

- The name and contact information of a company official you can contact for further information.

If an employer does not provide notice 60 days in advance of a closure or layoff, the employer is in clear violation of the WARN Act’s guidelines. At this point, the employer must administer back pay and benefits to each affected employee for that 60-day period or risk having to pay a significant fine.

What does all this mean for those affected by COVID-19?

Since the Court of Appeals ruled that COVID-19 is not considered a natural disaster under the WARN Act, many employers and employees must reevaluate their actions during the COVID-19 pandemic. Did your workplace follow proper WARN guidelines when laying off their entire workforce? Does the company meet the criteria under the WARN Act?

Maybe former employees never received proper notice of termination or did not have 60 days to prepare before being laid off. You might be wondering if there’s still a chance you can take this to court.

Unfortunately, WARN does not contain any explicit limitation period for employees to file complaints. Because the statutes of limitation vary by state, we encourage you to check and confirm the limitations set by your state or the state in which the site of employment is or is headquartered before deciding on any action.

And What of Remote Workers?

The term “single site of employment” is tossed around throughout the WARN Act’s protocol and qualifications. With a significant increase in remote employment over the last few years, employees call for concern. The term “single site of employment” has people worried that they might be terminated without notice or remedy.

The FAQ section of the WARN Act clarifies that a “single site of employment” is an employee’s designated base of operations — the place where their work is assigned or to which they report.

This initially referred to traveling salespeople or transportation workers, but this criterion also applies to employees working from home.

How to Know Employers Complied

If an employer meets the WARN Act coverage requirements and notified you 60 days ahead of losing your job, then they most likely followed the WARN Act’s protocol.

However, if an employer covered by the WARN Act did not issue a proper notice and chose not to compensate you, then they are in clear violation of the WARN guidelines and may be held liable.

If you have any questions about your experience being terminated, let us know. Any concerns about your employer’s method and reasoning for termination? Contact the Shub Law Firm today to hear what you’re entitled to.

SHARE ON: